As we navigate the digital revolution, two key drivers have emerged as powerhouses of transformation: artificial intelligence (AI) and cryptocurrency. They have both shown enormous potential independently, but when coupled together, they have the potential to revolutionize the way we invest in cryptocurrencies. AI-powered apps are disrupting traditional investment strategies, offering a new, intuitive approach to investing.

The AI-Crypto Connection

Understanding the interplay between AI and cryptocurrencies requires a nuanced understanding of each concept. Cryptocurrencies are digital or virtual currencies that utilize cryptography for security. Their decentralized nature, alongside the promise of low transaction costs, speed, and anonymity, has driven their popularity in recent years. By contrast, AI is a computer science field that explores the creation of intelligent machines capable of performing tasks typically requiring human intellect.

The fusion of these two distinct fields is engendering new paradigms for cryptocurrency investing, characterized by unprecedented efficiency, accuracy, and potential for profitability.

The Power of Artificial Intelligence in Crypto Investing

As the crypto market becomes more complex and volatile, investors need intelligent systems that can offer insights beyond human comprehension. This is where AI comes in.

1. Prediction and Analysis

Artificial intelligence algorithms can analyze vast amounts of data, making accurate predictions about crypto price movements. This data may include historical prices, trading volumes, market sentiment, and even global macroeconomic indicators. The AI’s ability to integrate these diverse data sources into predictive models gives investors an edge in their investment decisions.

2. Algorithmic Trading

AI also supports algorithmic trading, an automated process that executes trades based on predetermined rules. High-frequency trading firms use these systems to maximize their profits by capitalizing on even the smallest market movements. Such techniques are now available to individual crypto investors, thanks to AI-powered apps.

3. Risk Management

Crypto markets can be notoriously volatile. AI-driven risk management tools can help investors manage this volatility. These tools can analyze an investor’s portfolio, gauge their risk tolerance, and suggest strategies to mitigate potential losses.

The Emerging Ecosystem of AI-Powered Crypto Investment Apps

AI-powered crypto investment apps have emerged as a bridge between artificial intelligence technology and investors, democratizing access to advanced investment strategies. These apps employ machine learning, predictive analytics, natural language processing, and other AI technologies to empower crypto investors.

Trading Bots

AI trading bots use artificial intelligence and machine learning to automate trading decisions. They can analyze market trends, execute trades, and even adjust their algorithms based on new data. This enables 24/7 trading optimized for maximum profitability. AI-powered trading is definitely the future of trading, and platforms such as Immediate Edge can help you stay ahead in your future dealings.

Portfolio Management Apps

Apps like NapoleonX and Stacked help investors manage their crypto portfolios. They can analyze performance across multiple exchanges, suggest portfolio diversification strategies, and automatically rebalance portfolios based on user-defined rules.

Market Intelligence Platforms

Platforms like Santiment and IntoTheBlock offer AI-powered market intelligence, providing deep insights into market trends, investor sentiment, and predictive analytics. They help investors stay informed and make data-driven decisions.

An In-Depth Look at AI Techniques in Crypto Investing

When we delve deeper into the mechanics of how artificial intelligence facilitates crypto investing, we uncover a wealth of techniques and processes designed to optimize investment decisions.

Machine Learning

Machine learning, a subset of AI, involves teaching a computer system how to make accurate predictions or decisions based on inputted data. AI-driven crypto investment apps use machine learning algorithms to predict future price movements based on historical data. These algorithms improve over time, refining their predictive models as more data is fed into them. This makes them an indispensable tool in the arsenal of the modern-day crypto investor.

Natural Language Processing

Another technique employed by artificial intelligence-driven apps is Natural Language Processing (NLP). NLP is a field of AI that gives machines the ability to read, understand and derive meaning from human languages. It’s often used in sentiment analysis, where AI systems gauge public sentiment about specific cryptocurrencies by analyzing social media posts, news articles, and blog posts. Such insights can provide investors with an understanding of the market’s mood, which can inform investment strategies.

Deep Learning

Deep learning is a more complex form of machine learning, modeled after the human brain’s neural networks. It allows AI systems to learn from vast amounts of data. While still in its nascent stages in the world of crypto investing, deep learning holds the potential to revolutionize the way investors analyze and predict market trends.

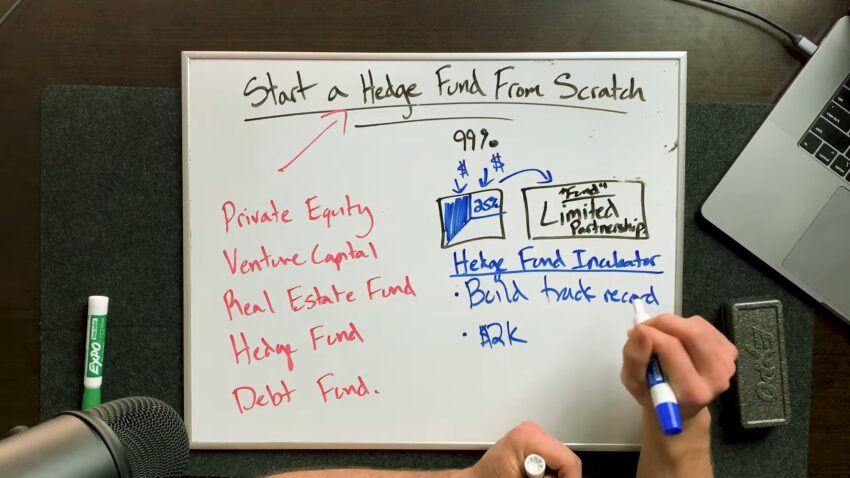

The Rise of AI-Driven Crypto Hedge Funds

Numerous hedge funds are leveraging artificial intelligence and machine learning to trade cryptocurrencies. For instance, Numerai, an AI-driven hedge fund, crowdsources machine-learning models from thousands of data scientists around the world. These models are used to make predictions about the market, which are then used to guide the fund’s investments.

The Way Forward: AI and the Future of Crypto Investing

While the integration of AI and crypto investing holds great promise, it also brings new challenges. Security concerns, market manipulation, and regulatory uncertainties are significant hurdles. However, the potential benefits of AI in crypto investing are too great to ignore.

As we look to the future, we can anticipate further advancements in AI that will bring even more sophistication to crypto investing. Deep learning, a subfield of AI, could offer even more powerful prediction models. Neural networks might one day understand and navigate the complex web of factors influencing crypto prices.

Moreover, as crypto markets mature and regulatory frameworks develop, we can expect the adoption of AI in crypto investing to increase. We may even see AI being used to shape these regulatory frameworks, ensuring that they evolve with the technology they regulate.

Final Words

The fusion of artificial intelligence and cryptocurrency has paved the way for a new era in investing. AI-powered apps have already made significant strides in empowering investors with sophisticated tools and insights. As we continue to innovate, these technologies hold the potential to redefine the landscape of crypto investing.

In this uncharted terrain, one thing is clear: the future of crypto investing is intelligent. AI, with its ability to process vast amounts of data, predict market trends, and automate complex tasks, is set to play a crucial role in shaping this future.